SAP Analytics Cloud (SAC) propels into Q3 2024, leveraging new features that enhance financial planning and strategic decision-making. This quarter, SAP introduces deeper integrations with Microsoft PowerPoint and advanced forecasting tools, paralleling innovations seen in tech leaders like Google and Amazon.

The highlight is the integration with Microsoft PowerPoint, allowing for live data updates directly in presentations—vital for real-time business decision-making. Deeper integration with Microsoft PowerPoint now allows financial planners to present up-to-the-minute financial data directly in their strategic presentations, ensuring decisions are based on the latest insights.

Additionally, 'Value Driver Trees' and 'Predictive Forecasting' tools are set to revolutionize scenario analysis, mirroring strategies employed by top consultancies like McKinsey & Company.

Stay tuned as we dive deeper into each feature and its implications for transforming business intelligence practices.

Key Updates in SAC Q3 2024: Special Focus on Financial Planning

The Q3 2024 update brings transformative enhancements across various functionalities within SAP Analytics Cloud (SAC). Here’s a breakdown of the significant updates designed specifically for enhancing financial planning capabilities:

Advanced Forecasting Tools

Value Driver Trees (VDTs): VDTs are a significant advancement in SAC, allowing financial planners to visually decompose financial targets into underlying drivers. These trees help in understanding the impact of different financial variables on overall outcomes.

For example, a VDT might break down revenue into components such as unit sales, pricing strategies, and market penetration, each influenced by various business activities. This tool is especially useful for scenario planning, as it enables planners to adjust assumptions or drivers and immediately see the potential impact on financial results.

VDTs now offer deeper integration with other SAC planning tools. This means you can seamlessly incorporate outputs from VDTs into your main financial models without manual data transfers.

Predictive Forecasting: The Predictive Forecasting feature has been significantly enhanced. Now leveraging more sophisticated machine learning algorithms, it can analyze extensive historical data to detect trends and forecast future financial scenarios with greater accuracy. This enhancement is crucial for reducing reliance on manual forecasting, improving precision, and offering varied scenario outcomes to aid in effective risk management and strategic decision-making. These improvements ensure that forecasts remain relevant and up-to-date with real-time data integration.

Enhanced Enterprise Planning

Dynamic Calculations: The Q3 update introduces more sophisticated formula options that dynamically respond to changes in the data. This feature allows financial planners to set up models that automatically adjust calculations when underlying data changes, which is crucial for maintaining the accuracy of financial models in a volatile market environment. Dynamic calculations can be used for everything from adjusting budget allocations in real time to recalculating financial ratios as new data becomes available.

Data Action Triggers: These are automated workflows that execute specific data transformations or actions based on predefined rules. For instance, if a financial threshold is reached, SAC can automatically adjust budget allocations or trigger an alert to the finance team. This automation minimizes manual intervention, ensures faster response times, and helps maintain data consistency across financial planning processes.

Plan Auditing and Data Entry Improvements

Smart Insights: This feature suggests optimal data entries based on trends and historical data. It's like having an intelligent assistant that proposes the most likely values during data entry, which speeds up the process and reduces errors. For financial planners, this means enhanced efficiency and reliability in data input, particularly during complex budgeting exercises or financial close processes.

Enhanced Audit Trails: With the new enhancements, SAC provides comprehensive logs of all changes made to the data, who made them, and when they were made. This capability is critical for compliance and for maintaining a clear record of financial decisions and modifications. It also includes rollback capabilities, allowing users to revert to previous states of data in case of errors or unintended changes, thereby safeguarding the integrity of financial data.

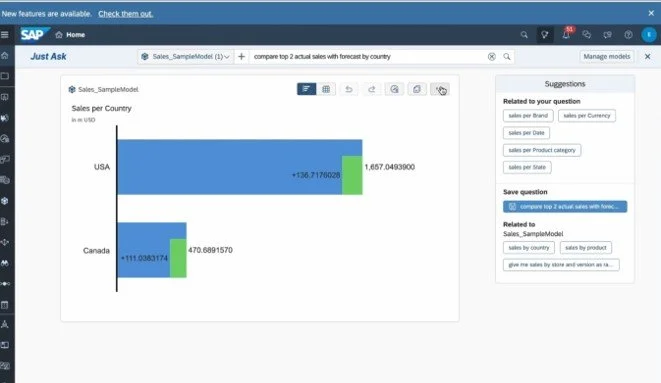

Enhanced User Interaction with Data: The upgraded 'Just Ask' feature revolutionizes how you interact with your data. By enabling natural language queries, SAC allows you to ask questions and receive answers quickly. This makes data analytics accessible to all users, regardless of their technical skill level, fostering a more data-driven culture within your organization.

Real-time Currency Conversion and Data Export

Currency Conversion: SAC now integrates real-time currency conversion, ensuring that financial reports reflect the latest exchange rates. This feature is invaluable for global businesses that operate in multiple currencies and need to consolidate financial statements into a single currency for reporting and analysis.

Data Export Enhancements: The latest update broadens the customization options available for data exports, allowing financial planners to tailor reports to the specific needs of different stakeholders. Whether it's exporting data in specific file formats or customizing reports with particular data slices, these enhancements make it easier to deliver relevant financial information across the organization.

These detailed features collectively enhance SAC’s capability to support comprehensive, accurate, and efficient financial planning.

Impacts of SAC Q3 2024 Updates on Financial Planning

The Q3 2024 updates to SAP Analytics Cloud (SAC) bring not just technical enhancements, but tangible benefits to organizations across various industries. Let’s explore some compelling use cases that demonstrate how these updates are being applied in the real world to drive significant improvements in financial planning:

1. Watco Companies LLC:

○ Industry: Transportation and Logistics

○ Application: Watco has implemented SAC for planning across its 200 field locations. The integration of SAC has transformed their financial planning and reporting processes, allowing for real-time data updates and on-demand metric delivery to teams. This enhancement has resulted in improved operational efficiency and alignment across the company.

○ Outcome: 95% improvement in the speed of metric delivery to teams, enabling more responsive decision-making.

Read the full case study on SAP’s site.

2. STIHL:

○ Industry: Manufacturing

○ Application: STIHL uses SAC to support data-driven decision-making, enabling effective corporate management with a single source of truth for financial planning. This approach ensures consistent and effective management practices throughout the organization.

○ Outcome: Enhanced corporate management and decision-making based on reliable, unified financial data.

3. Blue Diamond Growers:

○ Industry: Agriculture

○ Application: This agricultural cooperative utilizes SAC to enhance forecasting and planning related to demand and supply changes. The system’s predictive capabilities and real-time data integration help manage operational risks and improve responsiveness.

○ Outcome: Reduced IT downtime during ERP conversions and improved forecasting capabilities, supporting better overall business visibility and operational planning.

Each case illustrates the practical benefits of deploying advanced analytics and planning tools within SAP Analytics Cloud, highlighting its role in transforming financial planning from a static, reactive process to a dynamic, proactive practice. These stories provide a glimpse into the potential of SAC to revolutionize financial strategies across diverse sectors.

In Conclusion

The Q3 2024 enhancements for SAP Analytics Cloud are set to supercharge how businesses harness data for decision-making. With cutting-edge predictive analytics and smarter integration features, these updates not only make financial planning more precise but also a lot more intuitive. It’s about doing more with your data, faster and with greater confidence, ensuring every insight not only informs but transforms business strategies.

About the Author

Ndz Anthony is a certified SAP analytics consultant with an extensive portfolio in SAP BI consulting and tutoring. He enjoys sharing his knowledge through pieces of writing relating to BI and enterprise analytics.