In a previous project we had to introduce new depreciation areas in SAP Asset Accounting for tax purposes. This meant that, instead of the standard posting area 01 and tax area 15, we would be adding 6 new depreciation areas.

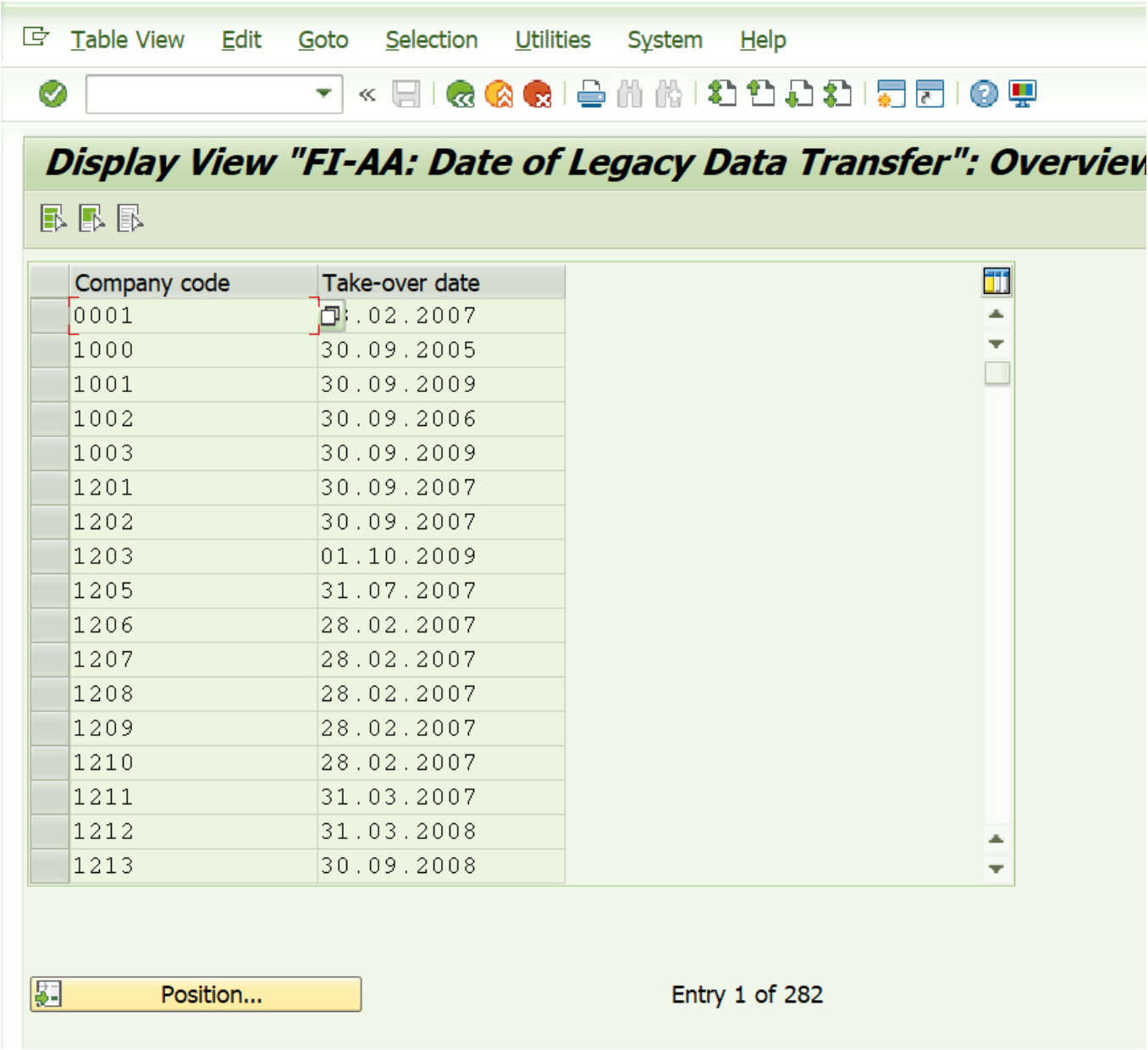

One of the required steps when adding of new depreciation areas, is that of changing the Last closed Asset Accounting Fiscal Year (T093B, ABGJA) to be the year prior to the asset take-on date of the company code (T093C, DATUM).

Transfer Date (T093C, DATUM)

Re-open Fiscal Year to year before Asset Transfer Date (T093B, ABGJA)

Opening the Prior Fiscal Years will allow the new depreciation areas to be added.

The purpose of this paper, is to highlight a seemingly insignificant issue that caused us much difficulty after opening the prior fiscal years, which should be avoided by all users of the SAP Asset Accounting system to ensure that if they ever have to re-open prior fiscal years, they do not encounter the same problems.

What was the problem?

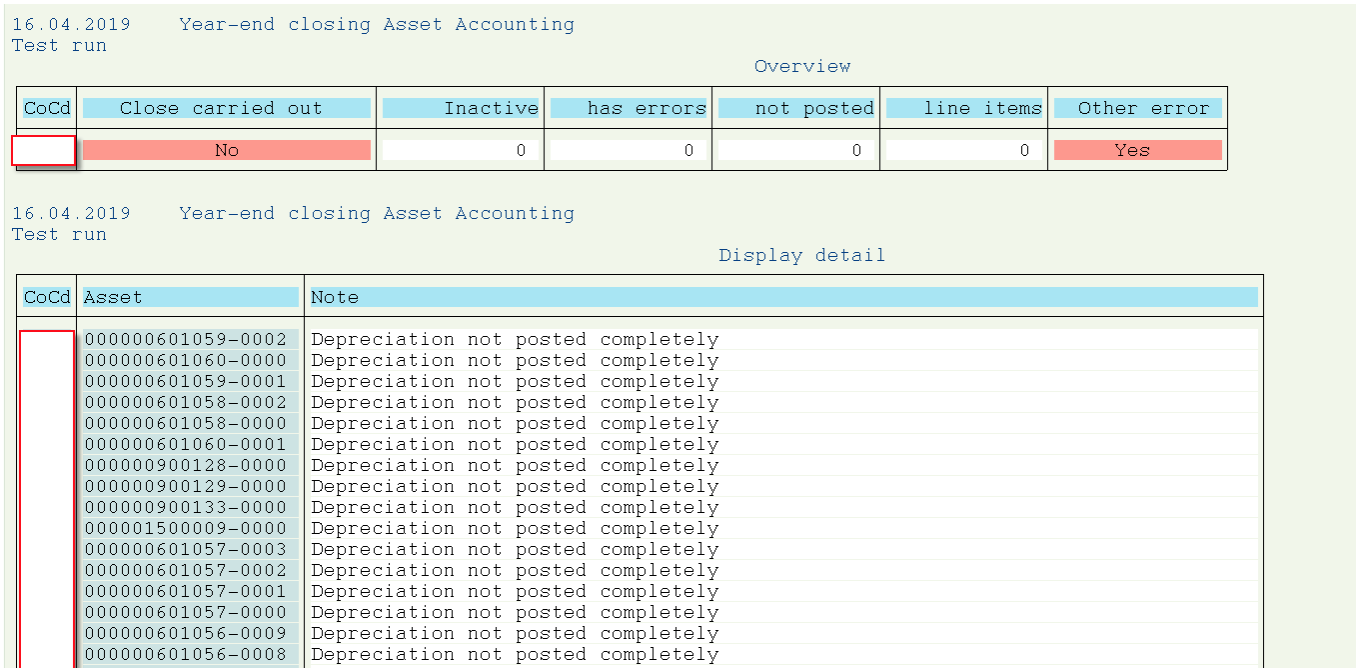

Once the years had been opened and the new depreciation areas had been successfully activated for the assets, it was time to close each fiscal year until we had caught up with the current fiscal year. When we ran transaction code AJAB so that we could close the fiscal years, we noticed that the system was proposing that it had to post depreciation to some assets, before we could close.

An example of what the screen looked like would be as below:

This was obviously an undesirable situation, since the depreciation calculation for these assets in the prior fiscal years had been posted and reported on already. Why was the system wanting to post additional depreciation?

What was the cause?

The opening up of prior fiscal years had opened up a can of worms, and it was important for us to find out why the system wanted to post depreciation in those prior years?

Our investigation led us to the following discovery:

On transaction code AS02, one is able to change depreciation parameters of an asset. These include the following:

Depreciation Key

Useful Life (Years)

Useful Life (Periods)

Variable Depreciation Portion

Scrap Value Amount

Scrap Value Percentage

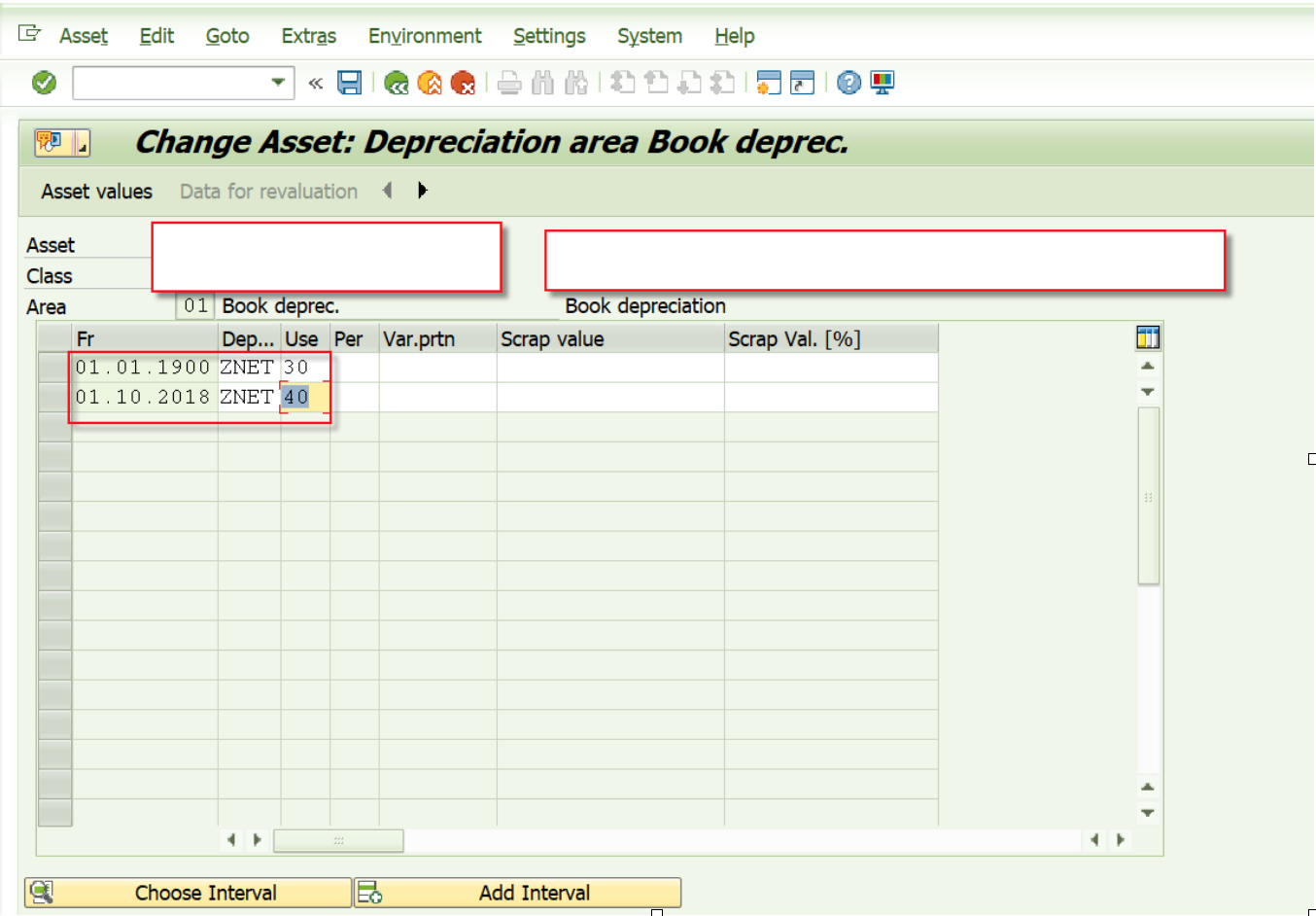

The users of this system, had made changes to these fields on numerous assets over the many years that the assets had been managed in the system. However, the changes had been made without specifying the time intervals from which this change was valid.

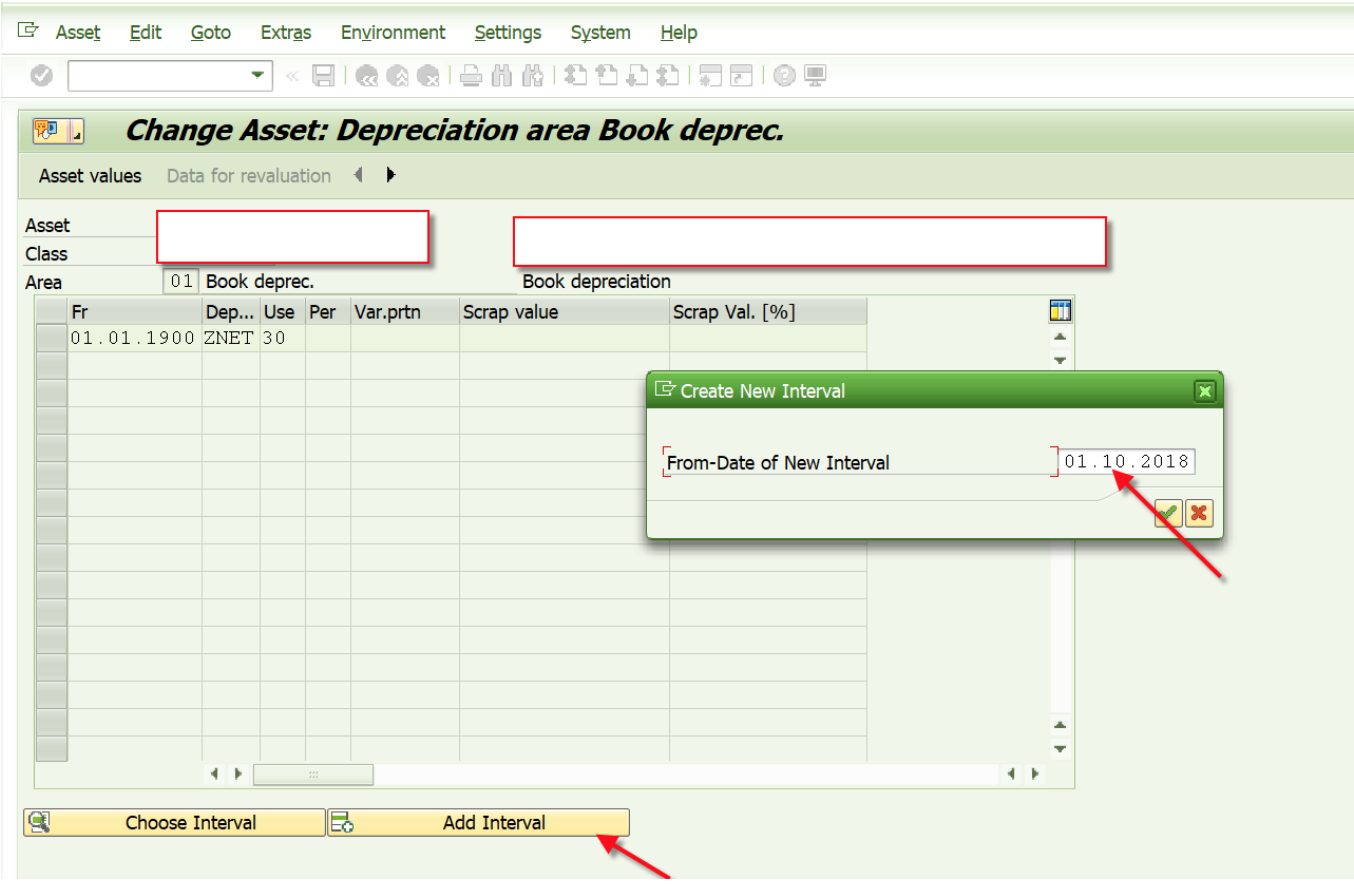

Instead of changing these fields directly on the above screen, the users should have followed good practice and selected the “More Intervals” icon, which would allow them to add a new interval from which the changes would have been valid.

What was the consequence?

Once it was decided to open the prior fiscal years, the system then checked what was currently sitting on the asset for the 6 depreciation fields specified above and if there were any changes, it would recalculate depreciation and propose the new value to be posted in that year before allowing the fiscal year to be closed.

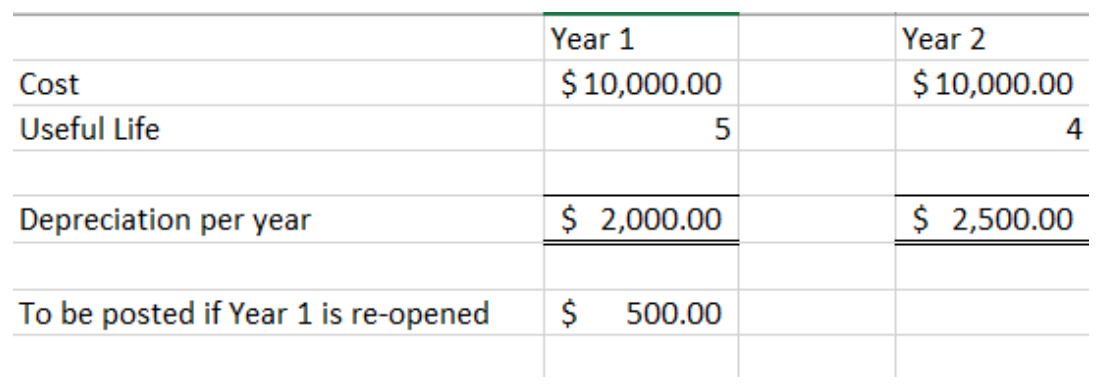

The worksheet below shows a simplistic example of the difference in depreciation calculation when you change a parameter like the useful life of the asset.

When changing the useful life in year 2, if there is no specification of a date interval, then if year 1 is re-opened, it will use the current depreciation parameters and re-calculate depreciation starting from year 1. This is where one will see the asset listed on AJAB and on AFAB, the R500 will be sitting as a To Be Posted Value in year one.

What was the solution?

Unfortunately, there is no easy fix for this situation (as far as I know). In our case, we went through a strenuous exercise of allowing AFAB to post the depreciation in the prior year, and then we had to reverse the posting out of the General Ledger since the Trial Balance and Income statement amounts of the prior years could not be changed. The extra depreciation was then also reversed out of the Asset Accounting sub-ledger through the use of special transaction keys which we created, that would post within the sub-ledger only.

The best solution is prevention in this case. ALWAYS specify a date-interval when you change the depreciation parameters and insist that all users of the system do likewise. When you use the interval option, the system does a re-calculation in the current period, so even if you open prior fiscal years, it will not have to recalculate the depreciation from the start.

Conclusion

Depending on the size of the organization and the number of assets, the results of not specifying a date interval for depreciation parameters can have far-reaching consequences. If for any reason, one needs to add new depreciation areas which calls for opening of prior fiscal years, these are issues to examine and verify before you open the closed fiscal years.