Rationale of Purchase Accounting

Purchase Accounting helps to get the details of all purchases made during the period. Typically it is required for legal reporting in certain countries where companies need to present a purchase register to statutory reporting. Due to special legal requirements, this function was developed specially for certain countries (Belgium, Spain, Portugal, France, Italy, and Finland).

Before you use this function, check whether you need to use it in your implementation country.

Configuration of Transaction Keys EKG, EIN and FRE:

Configuration is same as other account keys, transaction code OBYC or follow the below menu path.

SAP IMG - Materials Management – Valuation and Account Assignment – Account Determination – Account Determination With-out Wizard – Configure Automatic Postings –

Select Account Assignment

Purchase Account Transaction Key EIN –

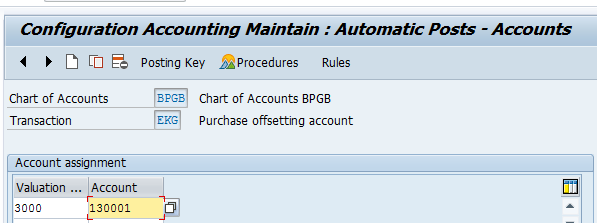

Purchase Offsetting Key Transaction Key EKG –

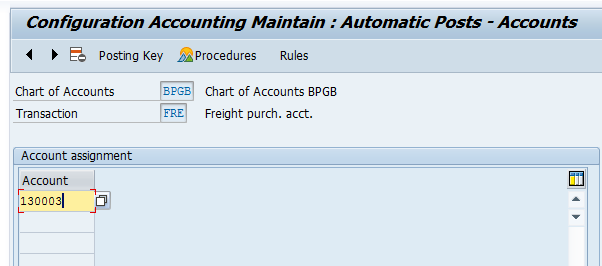

Freight Purchase Account Transaction Key FRE –

On Good Receipt the following double entry will be posted:

Stock A/c Debit 100

GR/IR A/c Credit 100

Purchase Account A/c Debit 100

Purchase Account A/c Credit 100

Delivery charges A/c Credit 10

Freight Purchase A/c Debit 10

Material Ledger Impacts

However it won't have any impact with these keys in ML as these Purchase Account Management Entries will be generated as the offsetting entries only in GR and in the same GR document these accounts get net off to zero. ML will consider the original entries with BSX transaction key only as EKG & FRE always equal to EIN. So no impact with these Purchase Account Management transaction keys.