Walk away from this session with an understanding of connection between product costing and logistics modules

- Look into the design aspects that are jointly owned by CO, MM and PP teams. (e.g. Resource / Work Center and their Standard Value Keys, Formulae for Activity Types).

- Review options to add freight, other incidental costs in the standard cost estimates and track actuals (e.g. Costing Sheet, Additive Costs, User exit for material valuation, Accrual pricing conditions in Purchase Order, etc.)

- Understand how to investigate and rectify messages encountered during product costing

- Deep dive into movement types and account determination, analyze MM-FI accounting flow

Watch The Recorded Webcast:

Q&A

Q: Is there an SAP transaction code to display CK13N for more than 1 material showing all line items?

A: CK13N is a great transaction to analyze cost itemization. However, as you have highlighted, it allows only one material-plant combination at a time. Unfortunately, there is no standard report which shows the same level of detail for many materials at a time.

Report S_P99_41000111 gets you somewhat close by showing cost components information in columnar format.

Most clients end up creating a customized report to meet this requirement. Function module BAPI_COSTESTIMATE_GETEXPLOSION can be of great help to give CK13N like output.

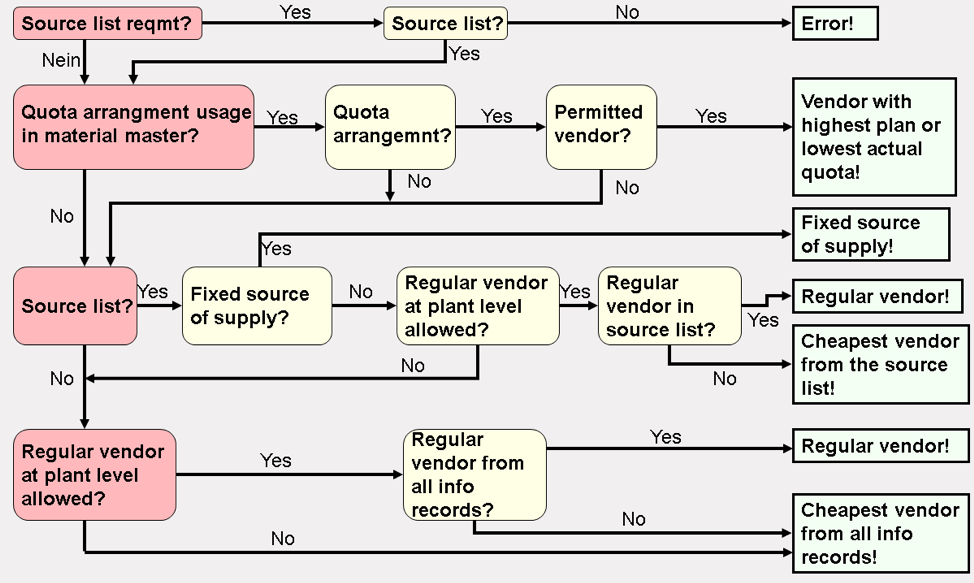

Q: If you have multiple PIRs and multiple source vendors list priority then how valuation strategy works?

A: Generally, PIR for the cheapest vendor is used. One can prioritize vendor selection using source list and quota arrangement. Refer to below decision tree from SAP Help which clearly shows various scenarios and costing result.

Source: https://help.sap.com/viewer/92419cca24534eaebb91b731261d911a/6.17.17/en-US/ab9194d4-d7d2-45b4-b0de-eb1be9356672.html

Path: Home Reference and Simulation Costing Use of Reference and Simulation Costing Unit Costing Origin of Data in Unit Costing Valuation of Costing Items Determining the Vendor

Q: On T-code KKML or CK90_99 of ECC 6.00. Is there a parallel T-code or CDS view in S4 Hana after upgrade?

A: KKML0 provides powerful reporting for material ledger – here the restriction of CKM3 (one material at a time) can be easily overcome. Apart from this, FCML* transactions help in reporting material ledger. They are available in ECC, as well as S/4HANA.

FCML_FILL to populate tables FCML_MAT, FCML_REP, FCML_CCS_REP that will enable better reporting on a mass basis

These programs and tables are already available in ECC system, one just needs to start filling them

These tables do not need HANA, they can be used with ECC setup

These tables are designed to provide improved reporting on a mass basis

These tables are kind of a bridge to HANA structures (full suite, including logistics) and are available automatically when the client upgrades to S/4HANA

FCML_NWG – this option provides network graphics

This option is built on FCML_XXX tables and does not need HANA

It requires activation of Web Dynpro

Following tables are relevant for reporting:

o FCML_MAT ML Characteristics for Material (Selection Criteria)

o FCML_REP ML Reporting Structure

o FCML_CCS_REP Cost Component Split Information (related to FCML_REP)

o FCML_PROC Business Processes

o FCML_ALT Procurement Alternatives

Material Ledger Drilldown Reporting needs only the tables FCML_MAT and FCML_REP.

Tables FCML_MAT, FCML_REP and FCML_CCS_REP can be joined via the unique ID “KALNR” (Cost Estimate No).

Q: For freight costs in standard - can we use PIR as source of data?

A: It should be possible to use PIR to pull freight data – condition type PR00 for base material cost and FRA1 for freight cost. Of course, M/08 pricing procedure should have rules to pull both the conditions. But one would think maintenance may become a bit cumbersome. Many clients use generic conditions (i.e. without linking freight condition to a material or vendor) or use percentage surcharge for ease of maintenance.

Q: For raw material usually will be moving average price control. In that case the costing sheet or additive cost cannot be used isn’t it? So, what is the best way to capture incoming freight for raw material with MVP?

A: Materials with price control of standard are good candidates for establishing a freight standard using costing sheet or additive costs. If you are using moving average price control, then these tools are not useful.

Two of the options discussed do not require standard cost setup.

- MR22 Debit / Credit Material (when using Material Ledger)

- Freight accrual pricing conditions in material Purchase Order

Note: Since there is no link to standard price, and only actual cost matters, one cannot track purchase price variance

Q: How about using Freight Unit linked to inbound delivery & do fright settlement as batch job for GRN done? This will load actual freight cost & will not need any reconciliation.

A: I believe you are referring to shipment costs associated in VI00? I have not explored this option, but one would think here too one will need to create an estimate for shipping costs initially, to be compared against actual invoice.

Q: For write offs can I define accounting treatment using reason codes?

A: OBYC MM-FI Account determination does not allow use of reason codes to determine GL account. If there are not too many reason codes, then maybe setup different movement types, pointing to different account modifiers and in turn to unique GL accounts. Alternatively, one can explore a user exit to influence this though.

Q: Since majorly all the SAP users are multinational companies, the exchange rate is important area for analysis. When the standard price is calculated for material it uses P exchange rate (Budget rate). When actual postings are made, in case of difference between standard and actual it is shown as price difference. But the breakup of rate calculated using P rate and actual M rate is not shown separately. How to show this without material ledger?

A: Transaction/ event key KDM (Materials management exch. rate diffs) allows separation of price differences related to exchange rates. Ideally, you want to map PRD and KDM to different accounts to capture the exchange rate differences in a separate account for visibility purpose. However, if you end up mapping KDM and PRD to the same account, then the analysis for exchange rate will need to be done at line item level (use field “Transaction key” BSEG-KTOSL)

Q: How to break up bundle cost part of Finished Goods? Basically, into marketing expenses as against in COGS?

A: I believe this question is in context of cost components. Expenses which are not part of inventory valuation (like Selling, Marketing) but need to track for profitability should be flagged in OKTZ cost component setup. These cost components can be mapped to specific value fields in KE4R. When sales invoices are posted, these cost components will flow to the appropriate value fields in CO-PA.

Q: Can you please let me know what is the use of OBYC PRD-PRA?

A: PRD-PRA is used for goods issues and other movements.

Q: how to update multiple prices for materials while releasing prices?

A: CK24/CK40N-Release allows release of prices for multiple materials.

Q: What if all six activity types are used up and I want to use 1-2 more?

A: As we know, SAP allow maximum of six activity types per operation/resource. If all six activities are already used, then one can create new operations using dummy work centers/resources where these new activities can be mapped.

Q: What is the SAP solution for FI-CO reconciliation in ECC 6.0?

A: When using new General Ledger, FI-CO reconciliation occurs in real-time.

Configuration path in ECC: Financial Accounting Financial Accounting (New) Financial Accounting Global Settings (New) Ledgers Real-Time Integration of Controlling with Financial Accounting

Additionally, CO-FI Real-Time Integration account is used from OBYB / OK17 to post transactions in Financial Accounting.